America has a long history of racial segregation and systemic racism that made it difficult for ethnic minorities to achieve financial and economic stability. Well-researched academic studies have found that “even after decades of growing diversity…most Americans still live in racially segregated neighborhoods.”

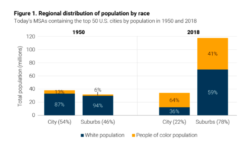

A study conducted by the University of Minnesota found that 64% of the urban city population are people of color while only 34% are white. Take a look at the graph below:

This data shows that in the 1950s, the suburbs were populated by a majority of white people (94%), and in 2018, they are still the majority (59%). While the cities have become even more populated by people of color in 2018 than in 1950.

This data is also reflected in another study that measures household income by net worth in the United States. The findings show that white households have disproportionately higher levels of income and higher net worths than POC households.

More specifically, in 2016, the median wealth of black families was $17,600, $20,000 for Hispanic families, and a whopping $171,000 for white families.

Take a moment to really internalize that wealth gap.

America’s flawed credit score system

There are many factors that negatively impact the economic disparities in America. One of the main culprits is the credit reporting system which has many flaws that disproportionately affect the POC population more than the white population.

According to Kenny Li, a credit expert at Finance Jar, these are the main issues within the credit reporting system:

- The system makes it hard to save money if you have a bad credit score and hard to get a good credit score if you have no money.

- The Bureau of Labor Statistics recently revealed that the weekly salary of Black Americans is around 20% below the national average. A survey also showed that the majority of Black Americans (54%) have only “poor” or “fair” credit, whereas this is the case for only 37% of White Americans.

- Credit reporting errors are surprisingly common (affecting 20% of the population), and these errors often restrict the types of credit and interest rates an individual can get.

- Disputing credit reporting errors requires certain legal, educational, and sometimes monetary resources that are often more readily available to White Americans than to POC. The disputing process is also highly automated, and this has led to numerous lawsuits.

Kenny Li emphasizes that there is a lot that needs to be done to update and improve the credit scoring system from within because it’s one of the reasons why POC people have a harder time getting loans, fair interest rates, and buying homes.

Similarly, POC people are approved for mortgages at far lower rates than their white counterparts. Kareem Saleh states, “Just look at the gap between Black and white homeownership, which is now wider than it was before the Fair Housing Act was passed in 1968. The people of color who do get approved are more likely to wind up paying higher interest rates than white borrowers.”

He continues, “These biased decisions were once made by humans, and now they’re made by algorithms.”

What can be done to limit algorithmic biases?

This trend shouldn’t be the norm. In 50 years from now, the statistics should be different. They should show rising equality for POC people. Entrepreneurs like Kareem Saleh are using innovative solutions to combat the biases within algorithmic systems like mortgage applications.

Kareem founded Fairplay to make sure that there was more fairness for historically disadvantaged populations. Innovators like Kareem are taking steps to make an impact on the issues that ethnic minorities face when applying for mortgages or trying to purchase their own homes.

Because there are biases within financial institutions that offer lending options like mortgages, Kareem intends to disrupt the system and impact financial inclusivity. This is one of many ways that the economic disparities in this country can be addressed.

Their research found that there were specific states in America that were fair to specific populations and unfair to others.

Here are some of their findings:

- The following 5 U.S. cities were the fairest for Black homebuyers (ranked from most fair to least fair): Los Angeles, CA; Portland, OR; Las Vegas, NV; San Francisco, CA; Phoenix, AZ.

- The following 5 U.S. cities were the LEAST fair for Black homebuyers (ranked from most unfair to least unfair): Cleveland, OH; Detroit, MI; Chicago, IL; Miami, FL; Atlanta, GA.

- The following 5 U.S. cities were the fairest for Hispanic homebuyers: Miami, FL; Los Angeles, CA; Phoenix, AZ; San Diego, CA; Las Vegas, NV.

These findings show that there are states in America that are more likely to treat homebuyers fairly and others that are more likely to be discriminatory. Owning a home is a huge economic advantage and it can influence someone’s net worth significantly.

If the algorithmic systems of mortgages are biased, and certain states are unfair to ethnic minorities, then the process of buying a home can be quite challenging. This makes sense because the statistics show that the homeownership rate by ethnicity favors the white population.

According to the Census Bureau, white households have a homeownership rate of 71%, while black and Hispanic households have a rate of 46%. Ethnic minorities have homeownership rates that are lower than the national rate which should be at 66%.

What does this data tell you?

This all demonstrates how wide the gap between white and ethnic minority households is. We need to focus on what can be done to level the playing field for future generations.

Kareem states, “If we open up the financial system to everyone, we will see greater wealth creation for all historically disadvantaged groups. Just as we built search and payments infrastructure for the Internet, so must we build fairness infrastructure that de-biases digital decisions in real-time, so that the discrimination of the past does not get embedded into the algorithms deciding our future.”

Final Thoughts

Like Nikki Attkinson said, “economic inequality is a structural problem that requires structural solutions.” It’s not going to take one social media post or one company to change the structural issues we see today.

However, with a combination of change in real estate firms, financial inclusivity, and workplace diversity, POC people will gradually get more opportunities for economic stability.

Photo by Michael Tuszynski from Pexels

- Impacting Education in Low-Income Countries – by Pearl Kasirye - June 25, 2022

- Diversity in Tech Tips – by Pearl Kasirye - February 9, 2022

- Algorithmic Biases & Economic Inequality – by Pearl Kasirye - November 15, 2021